To obtain your income tax number you should register online through e-Daftar or in person. 03-8911 1000 local number 03-8911 1100 international number 03.

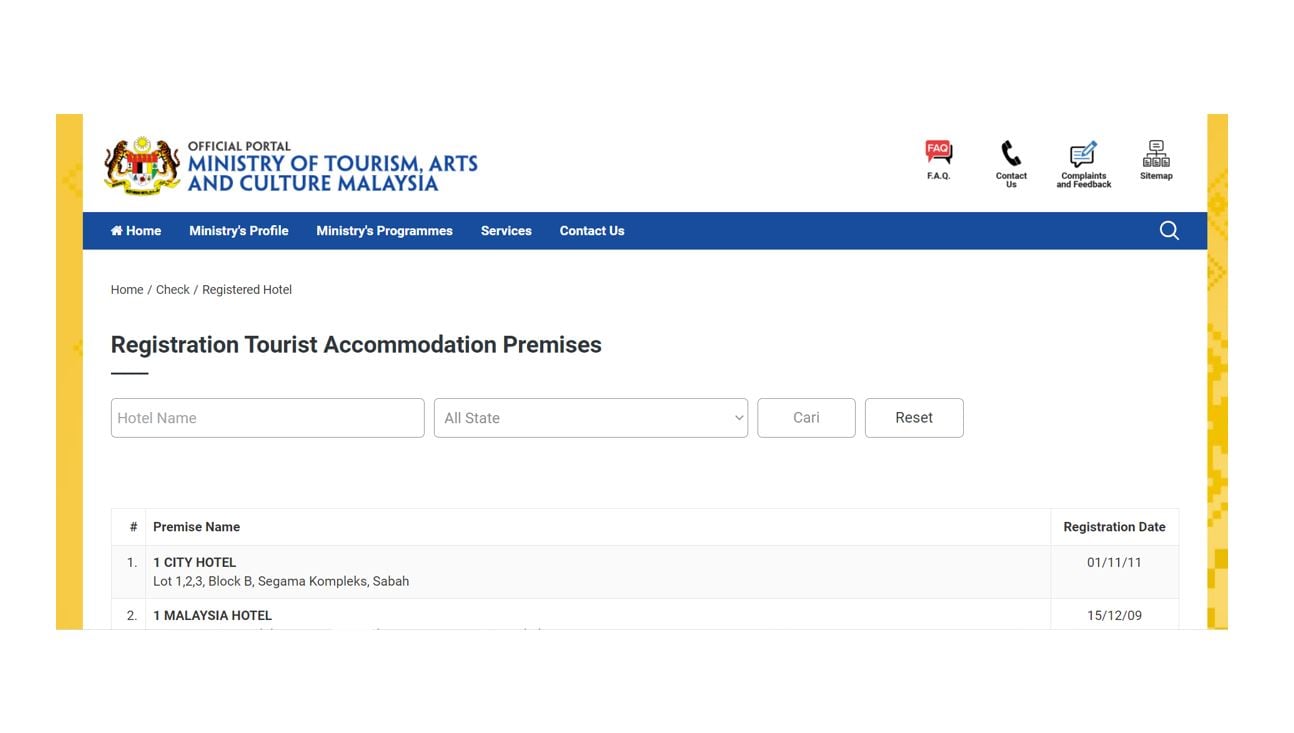

How To Check If Your Hotel Stay Is Eligible For The Tourism Tax Relief

I have register an income tax number and would like to declare income for the first time via e-Filing.

. If youve ever been employed you may already have a tax number you can check online or by calling LHDN. Inland Revenue Board Malaysia IRBM. Semakan Nombor Cukai Pendapatan Individu Lembaga Hasil Dalam Negeri Malaysia.

You can check by calling the LHDN Inland Revenue Board - please have your IC or passport number ready. The Income Tax Number is allocated by the Inland Revenue Board of Malaysia when you register for tax. You may find out by phoning the LHDN Inland Revenue Board be prepared to provide your identification card or passport number.

Malaysia Information on Tax Identification Numbers Updated 2 December 2020 Section I TIN Description Malaysian Income Tax Number ITN or functional equivalent In Malaysia both individuals and entities who are registered taxpayers with. You can apply to register an income tax reference number at the nearest branch to your correspondence address or at any LHDN branch without reference to your correspondence address. LLP under section 32 of the Limited Liability Partnership Act 2012 if relevant issued by the Companies Commission of Malaysia SSM List of partners.

Forward the following documents together with the application form to register an income tax reference number E-Number- 1. For Malaysian citizens and permanent residents you can find your Income Tax Number on your tax returns. StashAway Malaysia Sdn Bhd 201701046385 is licensed by the Securities Commission Malaysia Licence eCMSLA03522018.

Kad Pengenalan Baru tanpa simbol - seperti format berikut. 03-8911 1000 call within Malaysia or 603-8911 1100 call from oversea Fax number. Similar to Singapores CPF.

Two copies of Form 24 List of the shareholders of the company. Income Tax Number. Two copies 2 Form 9 - Certificate of Registration from Companies Commission of Malaysia CCM 3.

Here are the definitions of the mentioned statutory items. 03-8911 1000 Local number 03-8911 1100 Overseas number Not registered. Two copies of Form 49 Name and the address of the directors.

The unique reference number assigned to you by LHDN. Social Security Organisation is an organisation that protects Malaysian employees in accordance with the Employees Social. Account number of your bank.

Supporting Documents If you have business income. Two copies of Form 9 Certificate of Registration from CCM. Below is the guide to step-by-step on how to register LHDN Employer Tax.

How do I find my tax reference number Malaysia. Taxpayer will have to call the stated IRBM phone number to get the complete payment procedure for tax payment via telegraphic transfer. Two copies 2 Form 13 - Change of company name if relevant 4.

Kuala Lumpur 02 Ogos 2022 - Lembaga Hasil Dalam Negeri Malaysia HASiL dengan kerjasama Chartered Tax Institute of Malaysia CTIM hari ini menganjurkan Persidangan Percukaian Kebangsaan 2022 National Tax Conference 2022 NTC 2022 secara bersemuka serta dalam talian menerusi platform aplikasi Zoom. Your Income Tax Number is a unique reference number that is to be used by you in all dealings with the Inland Revenue Board of Malaysia Malay. Two copies of Form 13 Change of company name if applicable 4.

Employees Provident Fund that manages the compulsory savings plan and retirement planning for private sector workers in Malaysia. Of the treatment and a certification issued by a medical practitioner registered with the MMC must be kept for future reference and inspection if required. Sila masukkan e-mel dan nombor telefon yang berdaftar dengan LHDNM untuk memaparkan nombor cukai pendapatan dan cawangan.

Lembaga Hasil Dalam Negeri Malaysia abbreviated LHDNM. Section 28 or Form 13 from the Companies Commission of Malaysia CCM to. If you were previously employed you may already have a tax number.

A Copy 1 Memorandum and Articles of Association 2. If you do not have an income tax number yet please register for one either by.

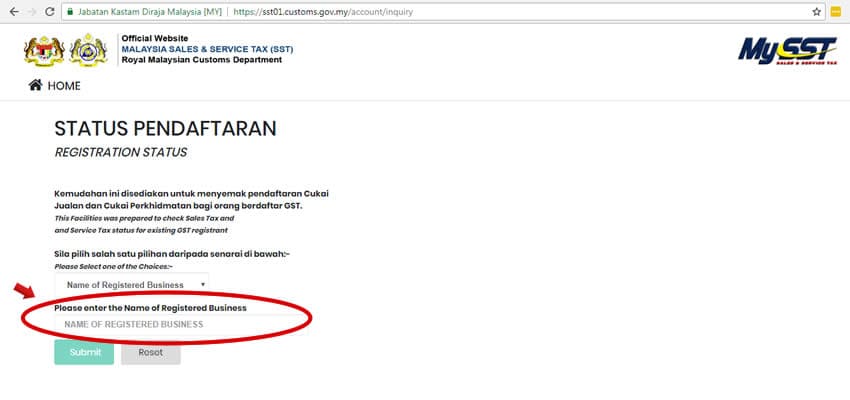

Malaysia Sst Sales And Service Tax A Complete Guide

How To Sell Online Payslips To Your Employees

Sample Cover Letter For Japan Visa Applicants No Itr In 2022 Writing A Cover Letter Cover Letter Application Cover Letter

Avoid Lhdn S 300 Tax Penalty Here S How To Declare Income Tax

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

How To Check Sst Registration Status For A Business In Malaysia

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

How To Step By Step Income Tax E Filing Guide Imoney

Sale And Purchase Agreement Malaysia Sample Ten Great Lessons You Can Learn From Sale And Pu

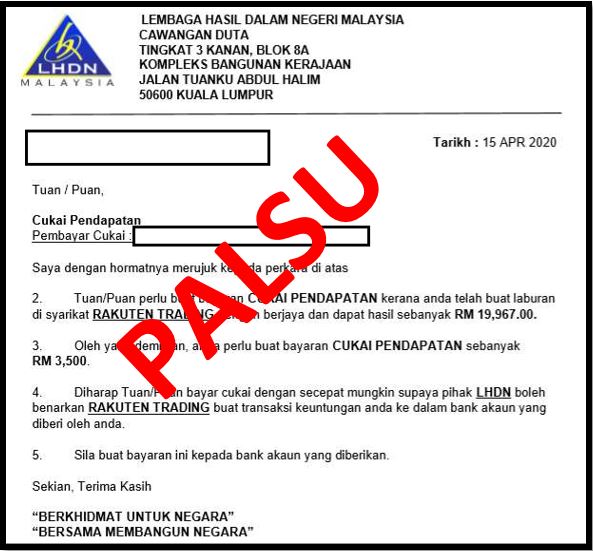

Beware Of Tax Scams Lembaga Hasil Dalam Negeri Malaysia

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

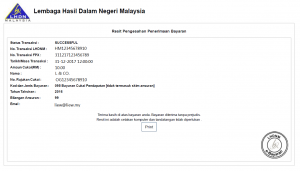

How To Pay Income Tax L Co Chartered Accountants

Here S A How To Guide File Your Income Tax Online Lhdn In Malaysia

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

.png)

How To Check Your Income Tax Number